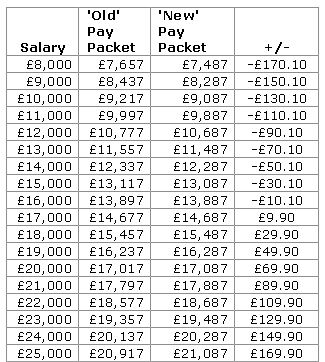

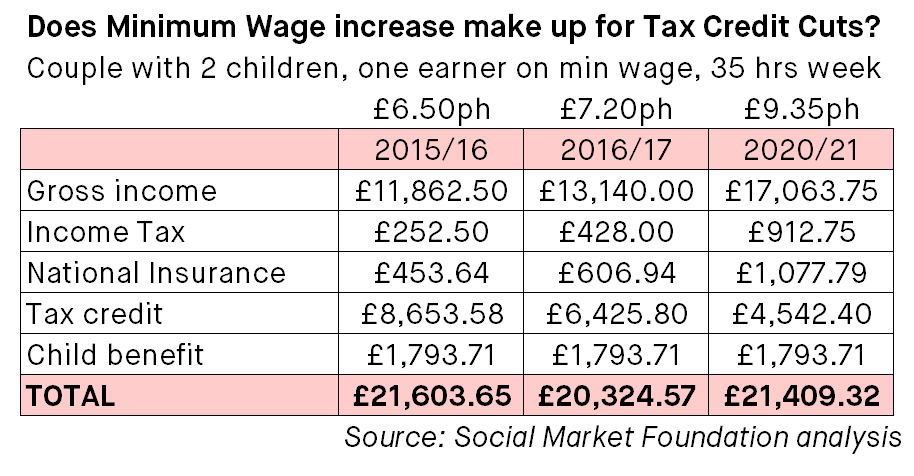

Will the new Living Wage make up for the cuts to Tax Credits? Yes and No. - Social Market Foundation.

Universal Credit and Working Tax Credit claimants may be able to get £1,200 tax-free bonus | Personal Finance | Finance | Express.co.uk

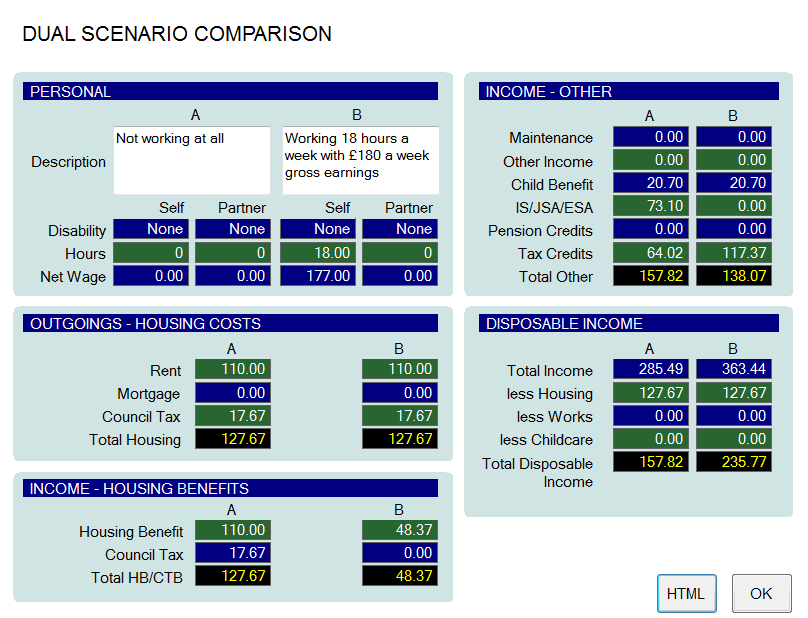

Jobs & Benefits Northern Ireland - You can claim Universal Credit online at www.nidirect.gov.uk/universalcredit. If you currently receive Working Tax Credits, read the information at https://www.gov.uk/working-tax-credit/further-information and use a ...